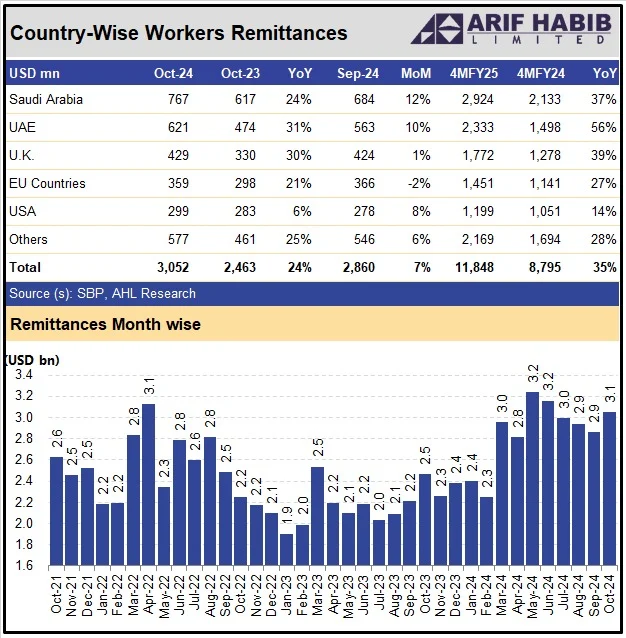

The State Bank of Pakistan (SBP) reported a significant increase in remittances for October 2024, with inflows rising by 23.9% year-on-year to $3.05 billion, compared to $2.46 billion in October 2023. This also marks a 6.7% increase from $2.86 billion in September 2024.

In the first four months of the current fiscal year (4MFY25), remittances surged by 34.7% year-on-year to $11.8 billion, up from $8.8 billion during the same period last year. Analysts credit the surge to a stable exchange rate, reduced disparity between open and inter-bank rates, an expansion in digital payment channels, and increased worker migration abroad.

Key Contributors to October Remittances:

- Saudi Arabia: The largest contributor, with $766.7 million sent by overseas Pakistanis, showing a 12% increase month-on-month and a 24% rise year-on-year.

- UAE: Inflows rose 10% from September, reaching $620.9 million in October, a 31% increase year-on-year.

- UK: Remittances totaled $429.5 million, up 1% month-on-month and 30% from October 2023.

- US: Inflows increased by 8% month-on-month, reaching $299.3 million.

- EU: Remittances declined slightly by 2%, totaling $359.1 million compared to $365.5 million in September.

The SBP has recently revised its incentive structure for banks and exchange companies to further encourage remittance inflows, introducing a mix of fixed and variable incentives.

Economic Impact

The increase in remittances has been a crucial factor in stabilizing Pakistan’s foreign exchange reserves, which reached $10.7 billion as of September 27, enough to cover more than two months of imports. Healthy remittances have played a vital role in supporting the balance of payments and alleviating the impact of the trade deficit.

The strong rebound in remittances since March 2024, averaging $3 billion per month, is seen as a positive sign, especially given the economic challenges faced by Pakistan, including record-high inflation and a near-default situation last year. The successful completion of the IMF’s stand-by arrangement in April has provided macroeconomic stability, with improved inflation rates and upgraded credit ratings by Moody’s from ‘Caa3’ to ‘Caa2’.

Outlook

With the new IMF loan program in place, Pakistan’s macroeconomic stability is expected to strengthen further. The combination of increased remittances and improved export performance is likely to keep the current account deficit under control, offering a more sustainable path for the country’s economic recovery.

To Keep Updated Visit & Follow our Facebook Page Or Our Website