ISLAMABAD: Kuwait Foreign Petroleum Exploration Company (KUFPEC) has decided to exit Pakistan’s oil and gas sector by selling its key assets, valued at nearly $60 million, to Pakistan Exploration (Private) Limited (PEL).

Reason for Exit

According to a senior official from the Ministry of Energy, KUFPEC’s departure stems from challenges in the sector, including:

- Massive circular debt of Rs2,700 billion, of which Rs1,500 billion ($600 million) owed to local and foreign Exploration and Production (E&P) companies remains unpaid.

- Delays in approving amendments to the 2012 E&P policy, with a 12-month backlog dissuading foreign investors.

KUFPEC’s Background and Past Commitment

- KUFPEC, a subsidiary of Kuwait Petroleum Corporation (KPC), was established in 1981 and operates in 10 countries across five continents.

- The company focuses on the discovery, development, and extraction of crude oil and natural gas outside Kuwait.

- In November 2023, KUFPEC signed MoUs with Pakistani companies, including Oil and Gas Development Company Limited (OGDCL), Mari Petroleum Company Limited (MPCL), and Prime Pakistan Limited, to expand its portfolio in Pakistan.

KUFPEC’s CEO Mohammad Al-Haimer previously expressed optimism, stating the MoUs would enhance the company’s assets, exploration capabilities, and partnerships in Pakistan.

The Asset Sale

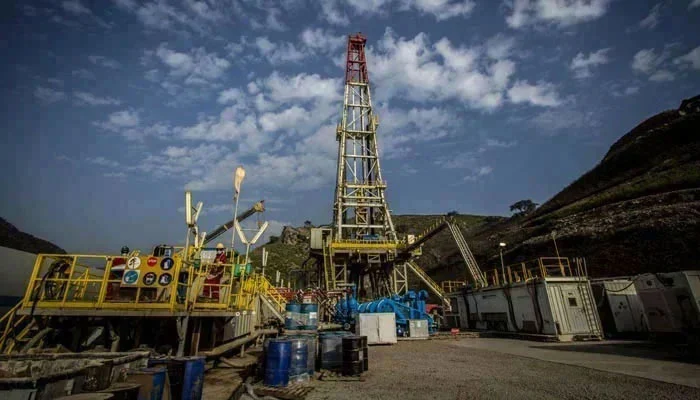

- The acquisition by PEL includes assets in the Dadu, Kirthar, Tajjal, and Qadirpur concessions, as well as Bhit and Qadirpur leases.

- PEL confirmed the acquisition, highlighting it as a strategic milestone to expand its exploration portfolio and strengthen its presence in Pakistan’s energy sector.

PEL’s Vision and Commitments

- PEL emphasized the acquisition aligns with its long-term strategy to explore energy opportunities and harness Pakistan’s natural resources.

- A PEL spokesperson stated, “We are confident that these assets will help us meet the growing energy demands of Pakistan.”

Impact on Pakistan’s Energy Sector

KUFPEC’s exit has raised concerns among policymakers about the sustainability of foreign investments in Pakistan’s energy sector. PEL’s acquisition, however, marks a significant development for domestic energy production and highlights the potential for local companies to take the lead in addressing the country’s energy challenges.

To Keep Updated Visit & Follow our Facebook Page Or Our Website