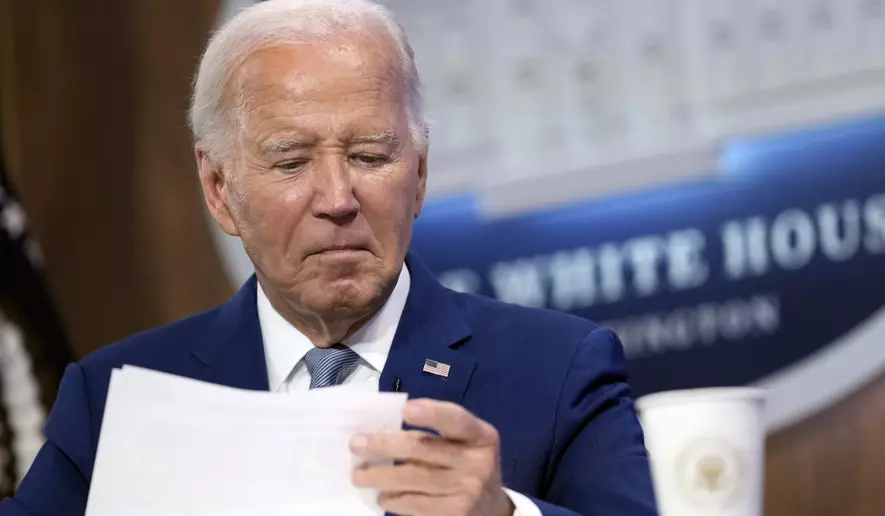

President Biden’s directive to increase IRS audits on higher-income Americans has raised concerns about a potential “marriage penalty” in the tax system. The Treasury Inspector General for Tax Administration (TIGTA) highlighted that this could occur as the IRS implements the new audit strategy.

The issue arises from how the Treasury Department has written the guidance, treating all “households” uniformly. As a result, a married couple, each earning $220,000, would face a higher likelihood of an audit than a single individual earning $390,000. This discrepancy stems from the administration’s focus on auditing those with annual incomes exceeding $400,000, a promise made by President Biden when advocating for increased funding for the IRS.

The IRS is currently working through the challenges presented by this potential marriage penalty, alongside other issues, as it plans to utilize the tens of billions of dollars allocated by Congress for enhanced audit efforts. The Inspector General has urged the IRS to expedite the finalization of its audit plan, given that the 2025 fiscal year is fast approaching.

The Biden administration assured that individuals earning less than $400,000 annually would not see an increased audit risk, while those above this threshold would. However, defining who falls into which category has proven complex. The IRS is cautious about relying solely on taxpayers’ reported total positive income (TPI) due to concerns that some individuals may manipulate their income reporting to fall below the $400,000 mark, avoiding higher audit scrutiny.

Additionally, the IRS has opted to use the 2018 tax year as a baseline for comparing audit rates, a year noted for its unusually low audit rates due to budget cuts and the pandemic’s impact on IRS operations. This decision reflects a pro-taxpayer stance, with audit rates in 2018 being significantly lower than in previous years.

The potential marriage penalty and the broader complexities of implementing the audit strategy underline the challenges the IRS faces as it seeks to fulfill the administration’s objectives while maintaining fairness in the tax system.