The Pakistan Stock Exchange (PSX) surged over 2,000 points on Friday, fueled by a strong macroeconomic outlook, continuing its record-breaking streak.

The benchmark KSE-100 index gained 2,294.64 points, or 2.36%, reaching 99,623.03 during intra-day trade, up from its previous close of 97,328.39 points.

Tahir Abbas, Head of Research at Arif Habib Limited, explained that the market is riding a wave of positive momentum due to strong economic indicators, improving macroeconomic conditions, and expectations of a drop in inflation to around 4.5% this month.

Abbas added that investors also anticipate further cuts in interest rates next month.

“The local liquidity is very robust. Money is continuously flowing into the market from different sets of investors,” Abbas remarked, highlighting the influx of funds from mutual funds, banks, and insurance companies.

Foreign exchange reserves, positive current account data, and privatisation hopes are also acting as catalysts for growth, he noted.

Across-the-board buying was observed in sectors such as automobile assemblers, commercial banks, fertilizers, oil and gas exploration companies, and power generation.

Pakistan’s foreign exchange reserves, held by the State Bank of Pakistan (SBP), rose by $29 million, reaching $11.29 billion—a 31-month high. The total liquid foreign reserves now stand at $15.97 billion.

Additionally, the Pakistani rupee appreciated by 0.11% on Friday, closing at Rs277.96 per US dollar in the inter-bank market.

Declining inflation, which has reached its lowest level since 2022, has bolstered investor confidence. Many are shifting their investments from fixed-income securities to equities, contributing to the PSX’s robust growth.

Despite the surge, analysts argue that PSX valuations remain attractive, with further room for growth.

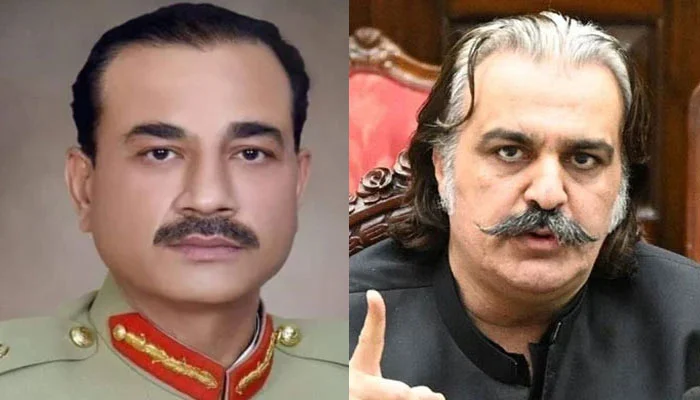

Mohammed Sohail, CEO of Topline Securities, noted that the market’s decline from 2017-2023 was largely due to political uncertainty. However, he added, “With inflation and interest rates declining, and Pakistan’s IMF relationship stabilising, economic recovery is strengthening investor confidence. If political protests remain peaceful, the index could cross 100,000 points soon and potentially exceed 127,000 by 2025.”

The political backdrop, however, remains tense. The opposition party, Pakistan Tehreek-e-Insaf (PTI), is planning a major protest in Islamabad on November 24, dubbed a “do-or-die” demonstration.

This protest, along with heightened militant activity in the northwest, has added to the political uncertainty and created a challenging environment for investors.

In the previous session, the PSX benchmark KSE-100 index rose by 1,781.94 points, or 1.86%, closing at an all-time high of 97,328.39 points.

To Keep Updated Visit & Follow our Facebook Page Or Our Website