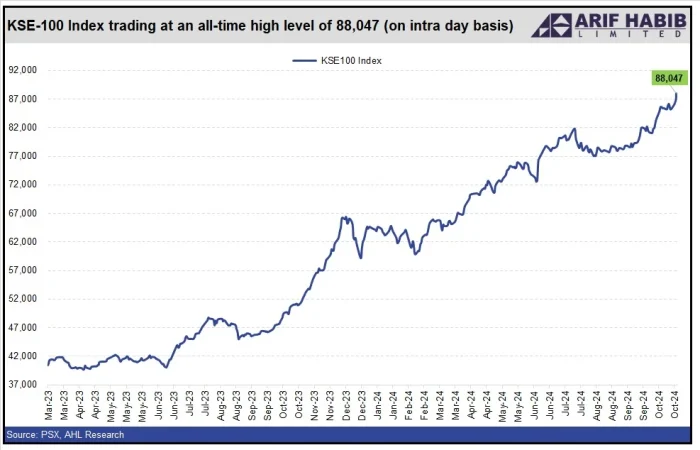

The Pakistan Stock Exchange (PSX) surged to a new intraday high on Thursday, crossing the 88,000-point mark, driven by optimism that the central bank may continue its easing stance due to declining inflation and improving macroeconomic indicators.

The KSE-100 index rose by 901 points, reaching 88,095 points during intraday trading at 11:07 am, up from the previous close of 87,194.53 points.

Saad Ali, Director of Research at Intermarket Securities, attributed the rally to the approval of Pakistan’s $7 billion loan under the International Monetary Fund’s (IMF) Extended Fund Facility (EFF) and reduced political tensions following the passage of the 26th Constitutional Amendment. However, the Pakistan Tehreek-e-Insaf (PTI) continues to express dissent.

Brokerage firm Arif Habib Limited (AHL) noted that the KSE-100 index’s climb above 88,000 points represents a 41.0% gain year-to-date in 2024, making it the fourth-best performing equity market globally. The index also saw an 8.5% month-on-month increase.

Analysts are anticipating a rate cut from the State Bank of Pakistan (SBP) in its upcoming Monetary Policy Committee (MPC) meeting on November 4, 2024, with a potential 200 basis point reduction as inflation has steadily decreased. Speculations suggest a total cut of up to 400 basis points by December, further fueling foreign investors’ interest in the stock market.

Inflation fell to 6.9% year-on-year in September 2024, the lowest since January 2021, down from 9.6% in August, driven by easing commodity prices and a stable currency, according to the Pakistan Bureau of Statistics (PBS). In response to the decline, the SBP previously cut its key policy rate by 200 basis points in September, bringing it down to 17.5%.