This year, the highly anticipated list of winners for the Top 25 Companies Awards for the year 2022 was published by the Pakistan Stock Exchange. This announcement of the list of the Top 25 Companies Awards winners is keenly awaited by the trade, business, and industrial world of Pakistan. The award-winning businesses have demonstrated excellence in their financial performance, operational and governance accomplishments, sustainability, and ESG related initiatives. The companies making it to this august list are a shining example of leadership for Pakistan’s corporate sector.

Since the inception of the Awards in 1978, to qualify for the PSX Top 25 Companies Awards, the companies have to meet select criteria. These criteria have evolved over time to include those standards by which companies are judged for excellence in the eyes of investors, analysts, fund managers and others. In 2018, where the winners had to meet criteria for financial performance and corporate governance & investor relations, the same progressed in 2020 to include Sustainability and Diversity & Inclusion reporting along with financial and other considerations. By 2022, this evolved to include reporting on SDG and ESG Related Initiatives as well. In other words, almost 22% of the requirements for qualifying for this coveted award included qualitative criteria.

Specifically, for the year 2022, the requirements included, but were not limited to, having a minimum dividend distribution of 30% and having shares traded for at least 75% of the total number of trading days in a given year. After meeting these requirements, the businesses were evaluated further using a combination of quantitative and qualitative standards. PSX used quantitative standards to choose listed companies which performed exceptionally well in the context of profitability ratios, dividend related ratios, and turnover of shares, among other specifics. In terms of qualitative criteria, PSX selected high-performing listed companies based on Corporate Social Responsibility (CSR), reporting on SDGs, ESG related initiatives including Diversity & Inclusivity, among other considerations.

The qualitative aspects of a company are also crucially important for the growth and success of that company. PSX’s giving weightage to these aspects demonstrates its commitment to steer listed companies with appropriate direction for their financial growth as well as focus on environment, social and governance factors. By incorporating these standards in the Top 25 Companies’ Awards criteria, PSX encourages listed companies to travel the path of corporate success and generate interest from investors, fund managers and analysts, among others, not only at the local level but also at a global level.

Since its inception, PSX’s Top 25 Companies Awards criteria recognition for top-performing companies has evolved to align with changing economic, social, and environmental dynamics. Here are key aspects of how the criteria has evolved specially related to the SDG/ESG aspect by 2022:

Including ESG Metrics: Environmental, Social, and Governance (ESG) factors are becoming more and more important. In addition to financial success, companies are currently assessed based on their social responsibility, governance practices, and environmental effect. This is in line with a global trend in which stakeholders and investors place a higher value on businesses that use sustainable and ethical business practices. Specifically, 10% of the total weight was thereby allocated to the criterion of ESG/ Sustainability for qualifying for the awards.

Diversity and Inclusivity: Within business frameworks, these two concepts are receiving more attention. Businesses that support diversity in leadership and cultivate a welcoming environment at work are recognised for their dedication to equality and social responsibility. Hence, Diversity & Inclusivity reporting carried a weight of 3.5% marks to be specific, in the qualitative criteria.

Overall, the evolving criteria reflect a broader understanding of what constitutes business success in a rapidly changing world. By considering a more comprehensive set of factors, PSX aims to encourage companies to adopt practices that not only drive financial growth but also contribute positively to society and the country.

PSX has also taken the initiative to sign UN Women’s Empowerment Principles and joined the United Nation’s Sustainable Stock Exchanges (UN SSE) Initiative. These initiatives show a deeper commitment to sustainability, ethical business practices, and gender equality within the Exchange. Moreover, PSX makes use of these affiliations as a means of increasing public awareness, promoting discourse, and supporting listed businesses to conform to these global sustainability and gender equality criteria.

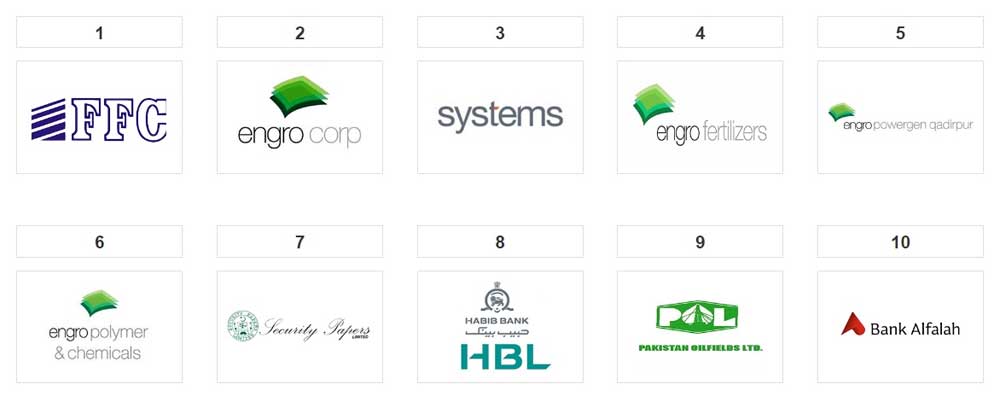

The Top 25 Companies Awards are the epitome of corporate success. The top three firms in the winner’s list for the year 2022 are Fauji Fertilizer Company Limited, Engro Corporation Limited, and Systems Limited while the remaining 22 companies solidified their status as the jewels in the crown of Pakistan’s top performers, showcasing their exceptional financial performance and strategic vision. PSX convenes the Top 25 Companies Awards ceremony to honour and recognise these top performing corporate champions. The event provides an opportunity to present these gems to the rest of the world.

As Pakistan’s economy continues to evolve, events like these will play an important role in acknowledging and promoting excellence within the business community. The recognition of the Top 25 Companies serves as an inspiration for emerging enterprises, encouraging them to aspire to the highest standards of performance, integrity and responsibility in conducting business practices. Hence, raising the performance benchmarks even higher year after year.

In conclusion, Pakistan Stock Exchange’s celebration of the Top 25 Companies not only highlights the success stories of these corporations but also serves as a catalyst for fostering a dynamic and resilient business environment. The event reinforces the importance of innovation, sustainable practices, and responsible corporate citizenship in shaping the future of Pakistan’s economy.

Top 25 Companies Awards Winners – 2022

Evolution and Integration of Pakistan Stock Exchange

Farrukh Khan: Pioneering leadership at the helm of PSX

The Pakistan Stock Exchange (PSX) stands as a crucial pillar in the country’s financial infrastructure, playing a vital role in channeling capital, facilitating investment, and contributing to economic growth. Established on September 18, 1947, the exchange has undergone significant transformations over the years, culminating in its formal incorporation on March 10, 1949, under the name ‘Karachi Stock Exchange’ (KSE).

As economic activities expanded in Pakistan, the need for regional stock exchanges became apparent. In response to this, a second stock exchange was inaugurated in Lahore in October 1970. This move aimed to meet the growing stock trading demands of the provincial metropolis, further diversifying the nation’s financial landscape.

In October 1989, another significant development took place with the establishment of the Islamabad Stock Exchange (ISE). This move was strategic, aiming to cater to investors in the northern parts of the country. Each of these exchanges operated independently, with separate management structures, trading interfaces, and indices.

The independent functioning of the three exchanges posed challenges such as fragmented operations, lack of standardized practices, and varying degrees of efficiency. Recognizing the need for a unified and more efficient stock exchange system, the Government of Pakistan promulgated the Stock Exchanges (Corporatization, Demutualization, and Integration) Act, 2012.

The groundbreaking legislation aimed to address the challenges by promoting corporatization and demutualization of the stock exchanges. Corporatization involved transforming the exchanges into corporate entities, subject to regulatory oversight. Simultaneously, demutualization aimed to separate ownership and trading rights, ensuring transparency and accountability.

On January 11, 2016, a historic moment unfolded as the three stock exchanges-Karachi, Lahore, and Islamabad-integrated their operations under the new name ‘Pakistan Stock Exchange Limited’ (PSX). This marked a paradigm shift in the country’s financial landscape, fostering a more cohesive and streamlined stock exchange system.

Key Impacts of Integration:

1. Unified Governance: The integration eliminated redundant management structures, streamlining governance and decision-making processes under a single entity, PSX.

2. Standardized Practices: With the integration, the stock exchanges adopted uniform trading interfaces, indices, and operational procedures, promoting consistency and efficiency.

3. Enhanced Market Attractiveness: A consolidated stock exchange increased market attractiveness for both domestic and international investors, fostering a more competitive and vibrant financial ecosystem.

4. Improved Regulatory Oversight: The integrated structure allowed for more effective regulatory oversight, ensuring compliance with industry standards and enhancing investor protection.

The evolution and integration of the Pakistan Stock Exchange reflect a commitment to modernizing and strengthening the country’s financial infrastructure. The establishment of PSX as a unified entity marked a significant milestone, addressing historical challenges and paving the way for a more robust and investor-friendly stock exchange. As Pakistan continues its economic journey, the PSX stands poised to play a pivotal role in shaping the nation’s financial future.

FARRUKH A. KHAN

MANAGING DIRECTOR /CEO PSX

In the dynamic world of finance, where acumen and strategic insight are paramount, Farrukh Khan stands as a beacon of leadership and expertise. As the Chief Executive Officer of the Pakistan Stock Exchange Limited (PSX), Farrukh brings a wealth of experience, knowledge, and a stellar track record that has left an indelible mark on the financial landscape.

Farrukh Khan’s journey to the top echelons of the financial world is marked by an impressive academic background. A qualified Chartered Accountant from the esteemed Institute of Chartered Accountants in England and Wales, United Kingdom, he complements this with a BA (Hons.) in Economics and Finance from the University of Manchester. This robust academic foundation forms the bedrock of his illustrious career, which spans over three decades.

With over 30 years of senior management and board-level experience, Farrukh is not merely a CEO; he is a seasoned entrepreneur and a trusted financial advisor. His tenure with Acumen, a pioneer in impact investing, showcased his prowess as he navigated roles such as Country Director & CEO, Pakistan, Senior Director Business Development, Chief Business Development Officer, and member of the Management Committee. His impact was not limited to the national borders, as he seamlessly integrated his expertise between Pakistan and the UK.

Before his role at PSX, Farrukh Khan served as the founding partner and CEO of BMA Capital Management Limited. Under his visionary leadership, BMA established itself as the leading investment banking group in Pakistan, earning international recognition, including the prestigious 2010 Euromoney award for the best investment bank in Pakistan. His stellar achievements include successfully managing the US$813 million GDR offering and London listing of OGDCL, Pakistan’s largest listed company, and advising on Etisalat’s monumental $2.6 billion acquisition of Pak telecom-the largest M&A transaction and foreign direct investment in Pakistan’s history.

Farrukh’s impressive track record extends to key transactions such as the US$1.5 billion privatisation of Kot Addu Power Company and the US$898 million GDR offering for Pak Telecom. His strategic counsel has played a pivotal role in almost 50% of all successful privatisations in Pakistan, amounting to over $4 billion in value. His professional journey also includes stints with American Express Bank in Pakistan and Deloitte in London, underscoring his global perspective and deep-rooted understanding of international business.

Beyond his corporate achievements, Farrukh Khan is a recognized leader in various capacities. He served as the President of the Overseas Investors Chamber of Commerce & Industry (OICCI) and chaired the Young Presidents’ Organization, Pakistan Chapter. His association with the Securities and Exchange Commission of Pakistan as a member of its Policy Board from 2018 to 2019 is a testament to his commitment to regulatory governance.

Acknowledging his exceptional leadership, Euromoney selected Farrukh as one of the top 50 global financial leaders under the age of 40. This recognition underscores his ability to innovate and drive change in the financial sector.

While Farrukh Khan’s professional accomplishments are formidable, his philanthropic endeavors reflect a commitment to societal well-being. His focus on children’s health and education demonstrates a holistic approach to corporate responsibility, aligning his professional success with a broader vision for positive societal impact.

Farrukh Khan’s journey from a qualified Chartered Accountant to the CEO of PSX is a testament to his unwavering commitment, strategic vision, and ability to navigate complex financial landscapes. His leadership at PSX is poised to be transformative, charting a course for sustained growth and innovation in Pakistan’s financial markets. Farrukh Khan is not just a CEO; he is a financial luminary, a trailblazer, and a catalyst for positive change in the world of finance.