Simran Kataria

The 2008’s global financial crisis highlighted the risks and vulnerabilities of the traditional financial system. With its emphasis on transparent operations, risk-sharing, and asset-based transactions, Islamic finance provides an alternative model that fosters financial stability and transparency.

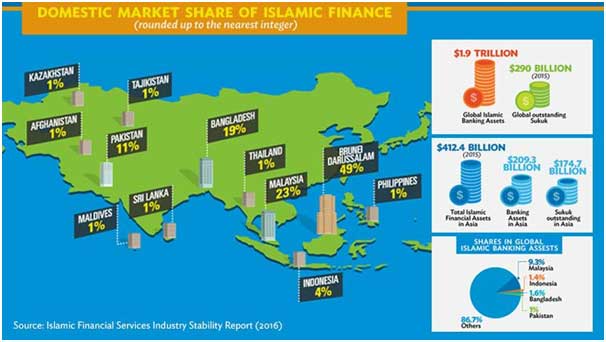

This approach has attracted investors looking for more stable and transparent investment opportunities: Islamic finance has recently witnessed rapid growth and gained significance in Asia and the Middle East. Islamic financial systems, including Islamic banks, insurance firms (takaful), and other organizations, have been developed in Muslim-majority nations such as Malaysia, Saudi Arabia, Qatar, and the United Arab Emirates. Another specific aspect that has driven attention is the issuance of Sukuk, the Islamic equivalent of bonds.

While it still represents a smaller share of the global financial market compared to conventional finance, its growth trajectory and expanding international reach are notable. The global Islamic finance market is experiencing significant growth and is expected to reach $6 trillion by 2024.

What is Islamic Finance?

The provision of financial services in accordance with Shariah Islamic law, principles, and standards is referred to as Islamic finance. Shariah prohibits receipt and payment of riba (interest), ‘gharar’ (extreme uncertainty), ‘maysir’ (gambling), short sales, and financing of activities deemed damaging to society.

Instead, the principle of partners sharing the risks and profits of a business transaction applies, and the transaction must have a genuine economic purpose without excessive speculation and must not contain any exploitation of either side.

By fostering economic progress, social welfare, and poverty alleviation, Islamic finance financing supports socially responsible behavior. Investments in industries like gambling, alcohol, cigarettes, and traditional finance with interest (riba) are avoided. It also emphasizes risk and reward sharing, opposes excessive speculation, and promotes investments in tangible assets and constructive economic activity.

Maintaining Financial Stability

Regulatory and supervisory structures have been devised to maintain stability in the sector. Regulators monitor Shariah compliance and enforce prudential requirements suited to the unique risks of Islamic financial firms. At the same time, adequate supervision aids in the identification of possible hazards, the maintenance of market discipline, and the stability of the Islamic financial industry.

Islamic finance is based on the risk-sharing principle, which states that both the lender (Islamic financial institution) and the borrower share the risks and rewards of a business transaction. Thus, the risk-sharing structure of Islamic finance lowers the chance of financial imbalances and excessive risk-taking – creating a more stable financial system.

Exploring available Shariah-compliant products

Islamic finance has expanded to include a wide range of industries and financial products. Banking, leasing, Sukuk (Islamic securities) and equities markets, investment funds, insurance (takaful), and microfinance are the primary components of Islamic finance. Banking and Sukuk assets account for a sizable share (95%) of total Islamic financing assets.

Shariah-compliant investment options available in Islamic finance feature equities, sukuk (Islamic bonds), and Islamic investment vehicles. Given the diversity opportunities and aid in risk management these products offer, investors are becoming more aware of the benefits of including Shariah-compliant investments in their overall investing strategies.

Apart from that, the Islamic financial ecosystem has seen the introduction of Shariah-compliant assets. Islamic Coin, which has raised a record 200 million during the private sale, and is gaining popularity in the Islamic financial market, is a good example. Launched in May 2023, the cryptocurrency operates on the HAQQ blockchain and seeks to empower Muslims worldwide with interest-free financial products to avoid riba.

Is it ethical to invest in Shariah-compliant financial products?

The global demand for socially responsible investing (SRI) or sustainable investing has increased: investors are becoming increasingly concerned about the impact of their investments on society and the environment.

SRI seeks to invest in firms and industries that follow ethical norms while avoiding initiatives with harmful social or environmental implications. For instance, investments in renewable energy, clean technologies, and environmentally friendly projects are encouraged.

As more seek ethical and socially responsible investing options, there is a growing trend for investments in Shariah-compliant financial products. Financial institutions and investment managers have been developing and extending their offerings of Shariah-compliant financial products and services.

This expansion has gone beyond Muslim-majority countries, with Islamic banking gaining a foothold in international financial centers and garnering the attention of investors. Many of the latter, both Muslim and non-Muslim, are drawn to the Islamic finance values of fairness, transparency, and social responsibility, seeking financial opportunities that are consistent with their personal values and beliefs.

Islamic finance market: creating new opportunities

Islamic financial institutions finance a wide range of industries, including infrastructure development, renewable energy, small and medium-sized enterprises (SMEs), and agriculture. These investments serve to create jobs, encourage economic growth, and contribute to overall economic development.

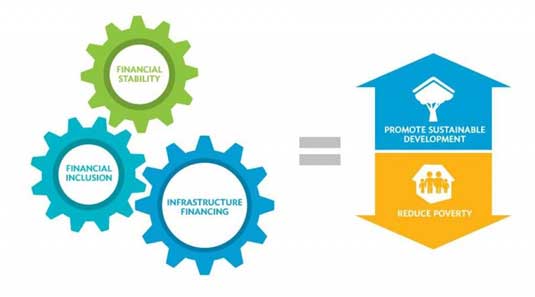

Islamic finance also assists in enhancing inclusion by providing financial services to all sectors of the population and acting as an alternate source of infrastructure funding while diversifying investors’ funding and risk exposures

Promoting Financial Inclusion

Islamic finance promotes financial inclusion by providing individuals and organizations with access to financial services who may have been underserved or excluded from existing financial systems. For example, Islamic microfinance provides Shariah-compliant financial solutions targeted to the needs of low-income individuals and small entrepreneurs, allowing them to access funds, start enterprises, and better their livelihoods.

In countries with large Muslim populations, there is a strong demand for Islamic financial products that align with their religious beliefs and principles. Islamic finance, including microfinance, has been recognized as a key tool in reducing rural poverty and promoting financial inclusion in Muslim countries.

Islamic microfinance institutions have successfully reached out to underserved populations, particularly in rural areas, who may have religious concerns regarding conventional microfinance products. It has bridged the gap for those who may be excluded from accessing traditional microfinance due to religious considerations.

Financing Infrastructure

Islamic finance provides an alternative source of long-term capital for infrastructure projects, contributing to economic growth, job creation, and improving public services. Through Sukuk issuances, governments and corporations raise funds for infrastructure development such as transportation networks, power plants, and social infrastructure.

Islamic Finance, reshaping the financial landscape

Islamic finance has emerged as a significant player in the global economy. While it still represents a smaller share of the global financial market, its rapid growth and expanding international reach are notable. As the benefits of Islamic finance are becoming widely recognized, Shariah-compliant financial products and services spread well beyond Muslim-majority countries.

By embracing the principles of fairness, transparency, and social responsibility, Islamic finance is reshaping the global financial landscape and opening doors to a more inclusive and sustainable economy.