KARACHI: Pakistan Stock Exchange (PSX) remained bullish on Monday amid formation of a new government, with the benchmark KSE-100 Index gaining 626.04 points (+0.96 percent) to close at 65,951.72 points.

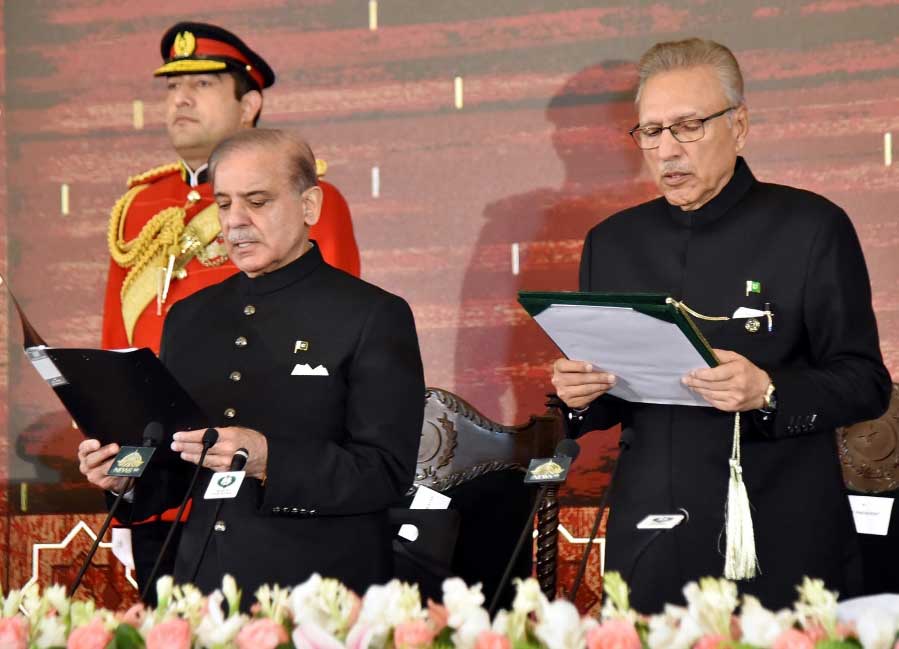

The market opened on a sharp positive note and throughout the day, the index experienced consistent gains. During the intraday, the index crossed the 66,000 points level. The experts said that buying came as political volatility in the country cooled off. Following the general elections last month, Shehbaz Sharif was elected on Sunday as the prime minister of Pakistan for a second term by securing 201 votes. Later, Sharif took oath on Monday as the 24th prime minister.

Additionally, a lower headline inflation reading for February gave impetus to sentiment that Pakistan’s central bank would start its monetary easing cycle earlier than expected. The investors were also optimistic about the economic outlook of the country. “The market is expected to remain positive on expectations that the newly elected government would negotiate successfully with the IMF for the final tranche of around $1 billion and commence talks for another loan program. On the economic front, the CPI for February rose by 23.06% YoY against consensus expectations of 23.65% while the trade deficit narrowed by 13.49% YoY to $1.7 billion in February,” Intermarket Securities said.

The benchmark index traded in a range of 474.85 points, showing an intraday high of 66,007.43 points and an intraday low of 65,532.58 points. Among other indices, the KSE All Share Index gained 420.11 points (+0.96 percent) to close at 43,689.05 points. Similarly, the KMI All Share Islamic Index gained 430.35 points (+1.36 percent) to close at 31,691.70 points.

Total volumes traded for the KSE-100 Index remained 211.69 million shares, while the overall market volumes remained 472.86 million shares. Among scrips, KOSM topped the volumes with 67.44 million shares, followed by WTL (60.21 million) and KEL (36.84 million). Stocks that contributed significantly to the volumes included KOSM, WTL, KEL, PTC, and OGDC, which formed over 44 percent of total volumes.

A total of 355 companies traded shares in the stock exchange, out of which shares of 184 closed up, shares of 150 companies closed down while shares of 21 companies remained unchanged. A total of 96 companies traded shares in the KSE-100 Index, out of which share prices of 57 companies closed up, 37 companies closed down and two remained unchanged. The number of total trades remained 183,267, while the value traded remained Rs16.28 billion.

In terms of rupee, MARI remained the top gainer with an increase of Rs68.45 (+2.78 percent) per share, closing at Rs2,530.5. The runner-up remained BHAT, the share price of which climbed up by Rs55.62 (+5.59 percent) to Rs1,050. RMPL remained the top loser with a decrease of Rs213.28 (-2.41 percent) per share, closing at Rs8,636.72, followed by PMPK, the share price of which fell by Rs40.33 (-5.22 percent) to close at Rs731.67 per share.

The major sectors taking the index towards north remained oil & gas exploration companies (389 points), power generation and distribution (67 points), cement (60 points), oil & gas marketing companies (54 points), technology and communication (51 points), miscellaneous (28 points) and fertilizer (25 points).

Major companies adding points to the index remained OGDC (103 points), PPL (71 points), MARI (32 points), HUBC (29 points), LUCK (25 points), PSEL (14 points), SYS and ENGRO (13 points each), PSO and APL (12 points each).

The major sectors taking the index towards south remained commercial banks (61 points), investment bank/investment companies/ securities companies (18 points).

Major companies depriving the index of points remained HBL (16 points), MEBL (13 points), HMB (11 points), FFC and DAWH (9 points each), COLG and BAFL (5 points each), FABL and ABL ( 4 points each), and SAZEW (3 points). – TLTP

Market gains 626 points as political volatility cools off